Tax Year 2026/27: Key Changes for SMEs

The 2025 Autumn Budget introduced significant changes that will take effect from April 2026....

Updates on UK tax regulations, accounting standards, and business tips.

The 2025 Autumn Budget introduced significant changes that will take effect from April 2026....

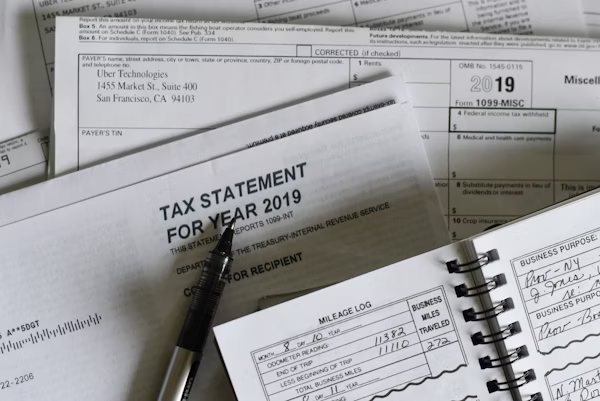

Ensure you are claiming all allowable expenses on your Self Assessment return...

HMRC has released a new timeline for MTD for Income Tax Self Assessment (ITSA)...

A comprehensive guide to the construction industry scheme and reverse charge mechanisms.

Why moving your books to the cloud is no longer optional for modern businesses.

How environmental, social, and governance reporting is becoming crucial for small businesses.

We don't just crunch numbers; we interpret them to help you make smarter business decisions. Our team combines UK qualifications with a deep understanding of cross-border business needs.

Annual accounts, payroll processing, and company secretarial services.

Learn More →Strategic advice on valuation, due diligence, and deal structuring.

Learn More →

Master UK taxation and accounting with our comprehensive video tutorials, lecture notes, and AAT exam preparation guides.

View Course Library